SERVICES OVERVIEW

We offer a range of solutions for all your mortgage needs!

A home is often the most valuable asset a person owns, so it’s important to get quality service.

Own your home today!

First Time Home Buyers

When you are a first time home buyer, it can be exciting and intimidating at the same time. There is a lot to learn about the home buying process and there are many options available. It is important to do enough research before deciding what home to purchase so that as a first time home buyer, you get the best deal possible on a mortgage for your new home.

As a first-time home buyer, you have the option to put as little as 5% down on your home. However, if you’re providing less than 20% as a down payment on your home, you may need to obtain mortgage default insurance which is commonly known as CMHC insurance. This type of mortgage insurance is available from three providers: Canadian Mortgage and Housing Corporation, Sagen, and Canada Guaranty.

Mortgage default insurance serves as insurance for the lender in case you can’t make your monthly payments. The higher your down payment, the less your CMHC insurance payments will be. Getting an insured mortgage or insurable mortgage can also help you get approved at the lowest mortgage rates available to you.

The First Time Home Buyers’ Tax Credit is a program that gives first time home buyers the chance to regain some of the costs they paid in the purchase. It mostly applies to closing costs such as legal fees and inspections.

Our customers have trusted us for years, and now it’s your turn! Contact us today for more information or to apply for a mortgage.

We provide a range of mortgage products to fit your individual needs.

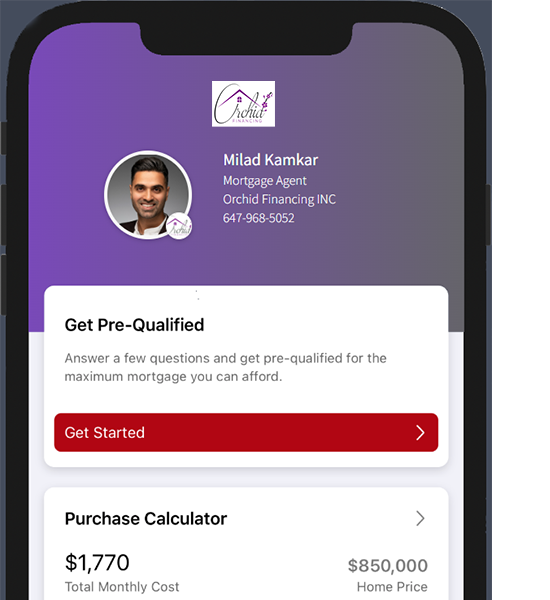

At Orchid Financing, we offer a range of solutions for all your home mortgage needs. Whether you’re looking to buy a new home or refinance an existing one, we’ll help you find the loan that works best for you.

What do you need to know about purchasing a home?

Mortgage Options

First time home buyers are often overwhelmed by the number of options available to them. It’s important to understand what kind of mortgage you want, so that you can make sure you find the right lender for your circumstances.

There are two options that lenders use to calculate interest rates, Fixed and Variable.

Fixed Rates work by keeping the interest rate the same for a period of time. These are best if you want certainty over how much your mortgage is likely cost every month.

Variable Rates fluctuate depending on what’s happening with the economy, as they generally move up and down based on the Bank of Canada Policy Rate.

Amortization and Mortgage Terms

Amortization is the length of time it takes for you to pay off the full amount of your mortgage.

In order to pay off your mortgage, you must agree on what are called Mortgage Terms. Everything your mortgage contract outlines, including rates, type and payments, make up your Mortgage Terms.

These terms need to be renewed, so it usually takes multiple terms to fulfill your amortization agreement.

Mortgage Types

When you’re buying your first home, it’s important to understand the difference between open and closed mortgages.

An open mortgage is one where you can pay extra money without any penalties in order to pay off the balance of your mortgage quicker, as well as the ability to renegotiate your term before it is up. With an open mortgage, you have more flexibility with how much extra money you can put toward paying down your debt.

A closed mortgage limits the amount of extra money you can pay on top of your usual payments without a penalty but is great for budgeting. Your payment never changes, and it is usually at a better interest rate than an open mortgage.

FREQUENTLY ASKED QUESTIONS

FAQ

To qualify as a first-time home buyer, you must not have owned and occupied a home that you or your current spouse or common-law partner owned for the past four years.

A 20 percent down payment is required to avoid the CHMC insurance premium. To qualify for a mortgage, you must have at least 5 percent of the purchase price available as a minimum down payment.

A home mortgage plan involves three main costs: the down payment (a lump sum you put towards the cost of your new house), closing costs (including lawyer’s fees), and a land transfer tax.

When you come to us to get a mortgage, we’ll ask for various financial information to help us make an informed decision about what type of mortgage will best suit your needs. We’ll also discuss the different decisions you need to make about what type of mortgage you want (open vs closed, fixed vs variable rate, amortization schedule), and we’ll work with lenders to make it happen!