SERVICES OVERVIEW

We See Things That Others Miss

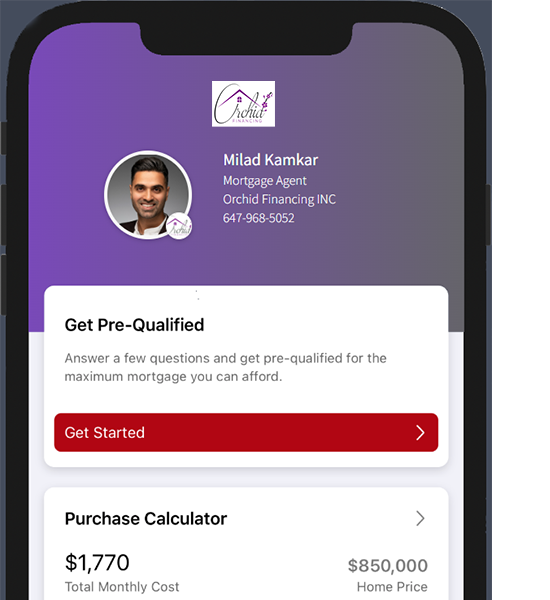

Not sure if you can afford a new home? Our team of experts offer financing solutions to help make homeownership a reality.

Own your home today!

New Home & Condo Purchases

If you’re looking to buy a home, you’ve come to the right place!

We help clients with all types of income and credit to secure mortgages for the home of their dreams. We are used to scouring the market for the best deals, based on your unique situation.

We specialize in helping people who have been turned down before by other lenders. Our experience has taught us that many people are unaware of what it takes to get approved for a mortgage, and we take pride in educating our clients with this knowledge and guiding them through the process.

We have the unique ability to connect you to large pools of banks, credit unions, monoline lenders, insurance companies, alternative lenders (B lenders) and private lenders who compete for your business. Because of our exclusive access to these lenders, we are able to offer you competitive interest rates and terms on all of our loans. Our customers have trusted us for years, and now it’s your turn! Contact us today for more information or to apply for a mortgage.We provide a range of mortgage products to fit your individual needs.

At Orchid Financing, we offer a range of solutions for all your home mortgage needs. Whether you’re looking to buy a new home or refinance an existing one, we’ll help you find the loan that works best for you.

What should you consider when purchasing a home?

Mortgage Options

When you apply for a mortgage, you have to decide whether you want it to be fixed or variable.

Fixed rates are best for people who are certain they will own their house for a long time. If you like the idea of knowing how much your monthly payment will be, and you aren’t worried about how interest rates might change over time, then a fixed rate is the way to go.

Variable rates are best for people who want to stay flexible. Since variable rates change depending on what’s happening with interest rates in the economy, they can save you money if interest rates in general go down, but they could end up costing you if the Bank of Canada raises rates and variable rate mortgages follow suit.

Amortization and Mortgage Terms

Amortization is the length of time it takes for you to pay off the full amount of your mortgage. The amortization period begins at the beginning of your mortgage and ends when you have paid off all of your loan.

In order to pay off your mortgage, you must agree on what are called the Mortgage Terms. Everything your mortgage contract outlines, including rates, type and payments, make up your Mortgage Terms. These terms need to be renewed periodically, so it usually takes multiple terms to fulfill your amortization agreement.

Down Payment and Other Costs

When you purchase a property that you put less than 20% down payment, you are required to insure your mortgage through one of the 3 major companies here in Canada (Canadian Mortgage and Housing Corporation (CMHC), Sagen and Canada Guaranty), your home for its full value – currently, up to $1 million. The premium for this insurance is usually between 0.5% and 1.0% of the loan amount.

For those who are thinking about buying a house in the near future, it’s a good idea to have a 20% down-payment so you can save the insurance premium.

Your other costs consists of land transfer tax, legal fees and appraisal.

FREQUENTLY ASKED QUESTIONS

FAQ

To avoid CHMC insurance costs, you must have at least a 20 percent down payment. You need to have at least 5 percent of the total cost of the home available, in cash or savings, to qualify for a mortgage. (House price to be $500k or less)

Prequalification is simply what you would like to hear which could be very misleading and inaccurate Vs preapproval which is having an underwriter from a bank review your circumstances and qualify you for an actual mortgage amount which unlike prequalification it’s very reliable to use.

We’ll help you figure out how much mortgage you can afford. The main things that impact your ability to afford a home are your income and expenses, as well as the size of the down payment you can make on the property.

The mortgage that best meets your needs depends on your financial situation and your personality. An open mortgage offers flexibility in payment options but also comes with higher interest rates. A closed mortgage offers lower interest rates but limits how much you can pay off on your mortgage without a penalty.

When buying a house, you will need to come up with three main costs: a down payment (a lump sum you put towards the cost of your new house), closing costs (such as lawyer’s fees) and a land transfer tax.