SERVICES OVERVIEW

Looking for a secure financial future? Learn more about reverse mortgages.

With a reverse mortgage, you can continue living in your own home while receiving the income that you need.

Schedule a free consultation

Reverse Mortgages

A reverse mortgage is a type of mortgage loan that allows homeowners over the age of 55 to borrow against the equity in their homes.

Reverse mortgages are structured so that the borrower never needs to make a monthly payment towards the repayment of the principal loan amount. The homeowner will continue to live in the home as long as they would like to live there. The reverse mortgage only becomes due if the borrower moves out of the home or sells the home. At that point, the principal amount plus all of the interest accrued since the mortgage loan was funded becomes due. This amount can never exceed fair market value of the home and can be deducted from proceeds of sale or repaid by refinancing or with another form of lump sum payment.

The only regular payments the borrower will be required to make during the term of their reverse mortgage are property taxes, homeowner’s insurance. These payments might be monthly or quarterly, depending on the policy of the municipality and homeowner’s insurance agreement for specific policies. If they have any second mortgages, then they might be required to make monthly payments on those loans.

A reverse mortgage is a type of home equity loan that provides tax-free cash proceeds to the borrower on the date of closing. This money can be used for whatever the borrower desires. For example, a borrower might use it to maintain his or her lifestyle and cover monthly expenses during retirement, help other family members such as their children and grandchildren build their wealth or pay for their education and other expenses, pay off debt, travel the world, renovate your home, buy a new car, or pay for medical bills.

Our customers have trusted us for years, and now it’s your turn! Contact us today for more information or to apply for a mortgage.

We provide a range of mortgage products to fit your individual needs.

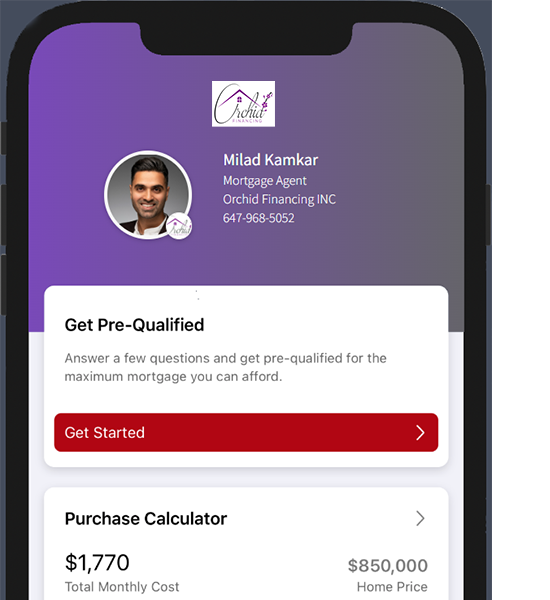

At Orchid Financing, we offer a range of solutions for all your home mortgage needs. Whether you’re looking to buy a new home or refinance an existing one, we’ll help you find the loan that works best for you.

Get all the facts about reverse mortgages here.

A reverse mortgage can be used to:

- Cover the day-to-day living expenses of your household.

- Pay for in-home care, health insurance premiums and medical expenses.

- Pay off outstanding debts.

- Purchase a vacation home, second home, or cottage

- Invest in real estate for yourself, your children, or your grandchildren.

- And much more!

Are you a good candidate for a reverse mortgage?

When you apply for a reverse mortgage, lenders will consider a few factors, including:

- Your age (55 or over) and the age of named owners on the property title

- All named titleholders must apply as joint borrowers

- Your home’s value, type and condition as determined by an appraiser.

- The property you’re applying for a reverse mortgage loan must be your primary residence, where you live for at least six months a year.

After you are approved for a reverse mortgage, the amount can be released either as a lump-sum payment or through regular payments over a set period of time. Lenders offer different payment options, with certain restrictions and fees. Our mortgage brokers will help you find the best option depending on your needs.

What is the cost of a reverse mortgage?

Depending on your lender, you may be required to pay certain fees upfront or add them to your loan’s principal.

- Higher interest rates compared to traditional mortgages

- Home appraisal fee

- Closing costs, including legal fees

- A prepayment penalty applies if you pay off your reverse mortgage before its due date

How can you repay a reverse mortgage?

You can repay the loan and interest in full at any time, such as when you move out, sell the property or upon death of the last named borrower. You can usually pay off a reverse mortgage using the proceeds from the sale of your home.

Reverse mortgages let you borrow against your home equity and don’t require regular payments until the loan is due. However, a payment may be due at any time if you wish to pay off your reverse mortgage early. Also, the longer you go without making payments, the more interest you accumulate on your loan. As a reverse mortgage allows you to borrow against your existing home equity, you may have less equity in the property at the end of the loan term.

Repaying your reverse mortgage is simple and affordable. Our mortgage brokers are dedicated to guiding you through the process of applying for a reverse mortgage and help you fulfill the loan obligations, so that you can maximize your home’s equity.

FREQUENTLY ASKED QUESTIONS

FAQ

As long as you continue to pay your property taxes and maintain the homeowners’ insurance policy on your home, you can remain in the house for as long as you live there or until you decide to sell it. Only then will any reverse mortgage principal along with the accumulated interest come due.

If you are at least 55 years old and have enough equity available in your home, then a reverse mortgage may be an option for you as long as you meet the other qualification requirements. Even if you are still building your careers, a reverse mortgage may still be a great option for helping with your finances in retirement.

Appraisals, site visits, and site inspections are required prior to the funding of your reverse mortgage loan.

No, it does not have to be your last mortgage. You can refinance a reverse mortgage, add a second mortgage, pay off the existing mortgage and obtain another mortgage, or buy another property and get a mortgage on that.