SERVICES OVERVIEW

We See Things That Others Miss

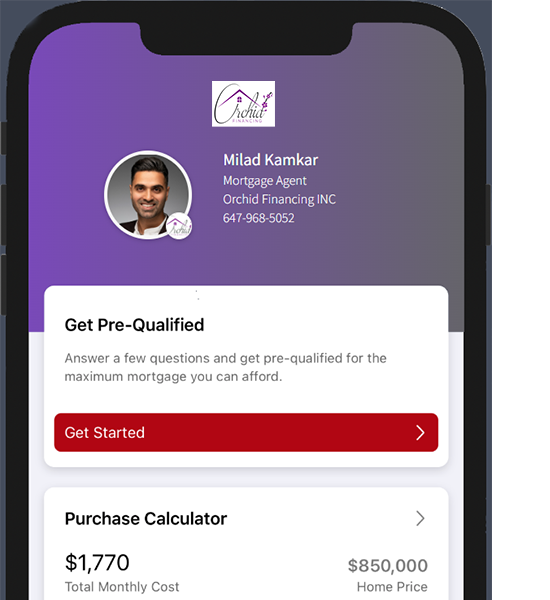

Not sure if you can afford a new home? Our team of experts offer financing solutions to help make homeownership a reality.

Own your home today!

Bad Credit Mortgage

Bad credit mortgages in Canada are a term that is used when someone who has poor credit, bad credit, horrible credit, or no credit applies for a mortgage loan.

Bad credit home loans in Canada are mostly available through alternative lenders and through channels that are not as well known for mortgages. Since banks and many other larger institutional mortgage lenders will only approve the lending of mortgages to individuals who have good credit, great credit, or excellent credit. It is important to understand that even if your credit is not too bad, you could still get turned away by the banks when applying for a mortgage and other mortgage related loans.

If you do have bad credit and need a mortgage loan then there are ways around this issue so it is important to understand how these lenders work and what they can offer you when looking at getting approved for mortgages for bad credit in Canada.

Key Features

Flexible Approval Criteria: Unlike conventional mortgages that require a high credit score, bad credit mortgages take a broader view of your financial situation. Lenders assess various factors, including income, employment stability, and the size of your down payment.

Higher Interest Rates: Due to the increased risk for lenders, bad credit mortgages often come with higher interest rates. However, these rates can vary significantly, Contact us so we can help you find the best deal.

Larger Down Payment: To offset the risk, lenders might require a larger down payment, typically ranging from 20% to 35% of the home’s purchase price. A substantial down payment not only increases your chances of approval but also reduces the overall cost of borrowing.

Shorter Term Options: Some lenders offer shorter-term mortgages for bad credit borrowers.

Our customers have trusted us for years, and now it’s your turn! Contact us today for more information or to apply for a mortgage.

We provide a range of mortgage products to fit your individual needs.

At Orchid Financing, we offer a range of solutions for all your home mortgage needs. Whether you’re looking to buy a new home or refinance an existing one, we’ll help you find the loan that works best for you.

How to Qualify

To qualify for a bad credit mortgage, it’s essential to demonstrate your ability to repay the loan. Here are some steps to improve your chances:

Stable Income: Show consistent income and employment history.

Reduce Debt: Pay down existing debts to improve your debt-to-income ratio.

Save for a Down Payment: The larger your down payment, the better your approval chances and the more favorable your loan terms.

Work with a Specialist: Mortgage brokers who specialize in bad credit mortgages can guide you through the process and connect you with lenders willing to work with your credit situation.

A brief overview of credit

Let's improve your credit score

If you’d like to improve your credit before getting a mortgage, we’d recommend paying all your bills on time, staying within your credit limit, and only applying for credit infrequently – applying for too many credit cards can negatively affect your score.

You can watch this video to get answer to some of your questions.

Take the First Step Towards Homeownership

At Orchid Financing, we understand that life happens, and your credit score shouldn’t stand in the way of owning a home. Our team of experienced mortgage brokers is here to help you explore your options and find a bad credit mortgage that fits your unique needs.

Contact us today to start your journey toward homeownership with a bad credit mortgage in Canada. Let’s make your dream home a reality, regardless of your credit history.

FREQUENTLY ASKED QUESTIONS

FAQ

A credit score of 574 or lower is considered bad. The lowest a credit score can go is 300.

A credit score of 680 or above is considered good. The highest possible score is 900.

To build credit quickly, pay off your debts, have more than 1 credit card / line of credit. Don’t use more than 50% of your available credit. lastly, repay them on time and try to make more than minimum repayments.

There are several steps you can take, such as bringing your accounts up to date, paying off your debt and working on rebuilding your credit with a credit card or loan, to turn bad credit into good credit.

A good credit rating can save you money on interest rates and financial fees on mortgage or credit balances. It can also increase your chances of being approved if you apply for a mortgage, loan or a credit card.