SERVICES OVERVIEW

At the end of the day, all we want is to help our clients succeed.

You’ve worked hard to own your home. Now make it work for you.

We offer solutions

HELOC (Home Equity Line of Credit)

A home equity line of credit (HELOC) is a line of credit based on the equity in your home. The amount you can access is limited by the amount of equity in your home, which is determined by subtracting the appraised value of your home from any existing mortgages. The more equity you have available, the larger the line of credit amount you can obtain.

HELOC loans are a great option for people who need access to their equity, as they allow consumers to borrow against their home with flexible terms and payment options. One of the biggest advantages of getting a HELOC loan versus other borrowing options is that you only pay interest on what you have advanced so you only need to pay for what you use.

A home equity line of credit—unlike high-interest loans or credit cards—is easy to obtain and designed to help you build your savings as quickly as possible. After being approved, you can access the available credit at any time without having to reapply.

Our customers have trusted us for years, and now it’s your turn! Contact us today for more information or to apply for a mortgage.

We provide a range of mortgage products to fit your individual needs.

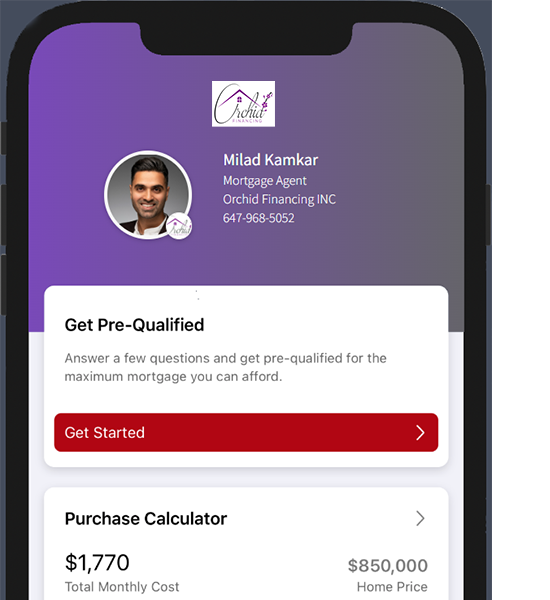

At Orchid Financing, we offer a range of solutions for all your home mortgage needs. Whether you’re looking to buy a new home or refinance an existing one, we’ll help you find the loan that works best for you.

Discover the benefits of a Home Equity Line of Credit

Fully Open to Repayment

A home equity line of credit can be repaid at any time and reborrowed if necessary, which gives you the freedom to repay only the minimum or pay off your entire balance at once if you choose. This can be attractive to clients who want to make larger payments than required each month as well.

Immediate Access to Equity

Once you register your HELOC, even if you do not advance the funds right away, you will be able have immediate access the funds typically in less than 24hrs and in most cases, online, directly to your bank account. This can be very important when opportunities arise, or in the case of needing emergency funds. This makes the Home Equity Line of Credit one of the most popular solutions for most clients.

Cash for Renovations

Home Equity Line of Credit (HELOC) allows you to tap into the equity in your property to finance renovations and have quick access to funds for emergency repairs, such as leaks or cracks in the foundation.

Cash for Investments

When a great investment opportunity arises, it’s important to be ready to act. Having quick access to funds through a home equity line of credit can help you take advantage of those opportunities when they arise and make the most of them.

Reduce Monthly Payments

By consolidating higher interest debts with a Home Equity Line of Credit (HELOC), you can reduce your monthly payments. We have helped many clients reduce their monthly payments by up to 75%. This allows our clients not only to better afford their obligations, but also be able to put money aside for what matters most!

Rebuild Credit

A home equity line of credit is typically registered on your credit bureau. By making consistent on-time monthly payments toward your balance, you will be increasing your credit score and working toward financial health.

FREQUENTLY ASKED QUESTIONS

FAQ

A home equity line of credit (HELOC) can be easily obtained if you have built up equity in your home. You can access your HELOC whenever you need it.

You will need an appraisal if you want your application for a home equity line of credit approved. We require this document to determine the value of your property, which in turn determines how much credit you are eligible for.

You can borrow up to 65% of your home’s value with a home equity line of credit in Canada. The value of your home equity line of credit combined with your mortgage cannot be worth more than 80% of the value of your home.