SERVICES OVERVIEW

Mortgage options tailored to your needs!

Discover our mortgage options, whether you’re a first-time buyer or an experienced investor with flexible options to suit your needs.

Don't Rent. Own

Bridge Loan

Bridge loans help home owners bridge the gap between the sale of their current home and the purchase of their new home.

It’s a short-term loan that helps you cover the period of time between when you receive money from the sale of your current home, and when you need that money to pay for your down payment on your new home.

An alternative to a traditional mortgage is a bridge loan. If you are looking to purchase a new home or commercial property but have not been able to sell your current property in time, you may need to consider a bridge loan. A bridge loan is also known as a gap financing solution and can help you obtain funds for the down payment on your new property or home.

Bridge loans are typically short term loans that range from a few months up to one year. In other words your house has not sold in time to give you the funds to put a down payment on the new home or property you are purchasing. This is where a bridge loan can really help by using the equity in your current property or home as collateral for a loan to put towards the purchase of your new commercial property or new home.

Our customers have trusted us for years, and now it’s your turn! Contact us today for more information or to apply for a mortgage.

We provide a range of mortgage products to fit your individual needs.

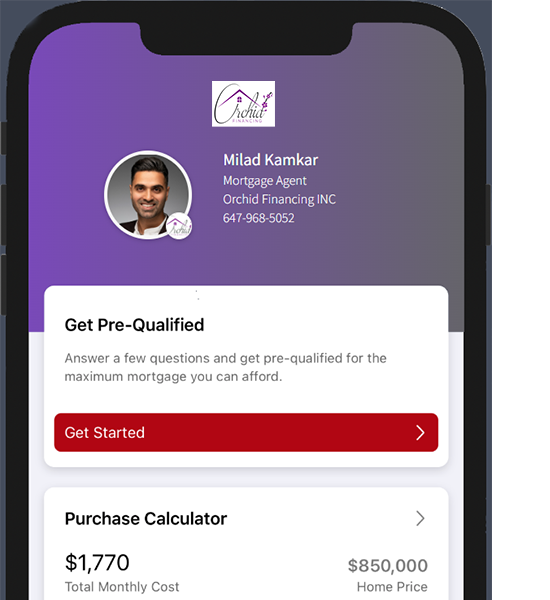

At Orchid Financing, we offer a range of solutions for all your home mortgage needs. Whether you’re looking to buy a new home or refinance an existing one, we’ll help you find the loan that works best for you.

What information do you need to know about bridge loans?

How much money can you get with a bridge loan?

Lenders will need to evaluate a borrower’s specific situation in order to give a borrower a maximum loan amount. Based on this information, the lender will also determine how much time the borrower will have to pay the loan back. In some circumstances you can opt for a longer term or higher amount of bridge loan. If more time or money is needed, the lender will need to consider various factors in order to decide if you qualify. Keep in mind for larger and longer loans a lien may need to be registered on your property. A qualified mortgage agent can help you determine the best course of action to take, and find the right lender for your specific needs and situation.

What are the additional fees?

As with any loan, a bridge loan has interest. The interest on a bridge loan is generally similar to the prime rate plus 2%. Bridge loans are typically issued over a short period of time and are repaid when the equity of your previous home or commercial property is collected after the sale closes. If you need a loan in excess of $200,000, it may be necessary to register a lien on your property; then, when you pay back the loan and want to remove the lien, you will need to hire a real estate lawyer.

How do you qualify for a bridge loan?

To apply for a bridge loan, you will need to provide the lender with a copy of the original purchase agreement for your new commercial investment or new home, and a copy of the sale agreement for your current property. However, if your closing date is not firm—meaning that you have not yet received approval from the seller to purchase their property, or the seller has not yet accepted your offer to buy—then you will need to turn to a private lender because most banks and traditional lenders will require a firm closing date in order to approve you for a bridge loan.

FREQUENTLY ASKED QUESTIONS

FAQ

Bridge loan payments are interest-only and calculated with simple interest. To calculate the monthly payment, multiply the loan amount by the interest rate and divide by 12 months. There are no principal repayment payments during the term of the loan.

It can be challenging for self-employed people to secure financing. Luckily, for bridge loans, lenders don’t require documentation of income. Instead, they will request documentation to verify your financial strength, such as copies of your bank statements.

Bridge loans are typically paid off within 12 to 36 months. However, they can be paid off early with no penalty and many can also be extended if needed.

Foreigners can use bridge loans, which are designed to be flexible. You do not need credit history or income forms to qualify for this type of loan.