SERVICES OVERVIEW

We See Things That Others Miss

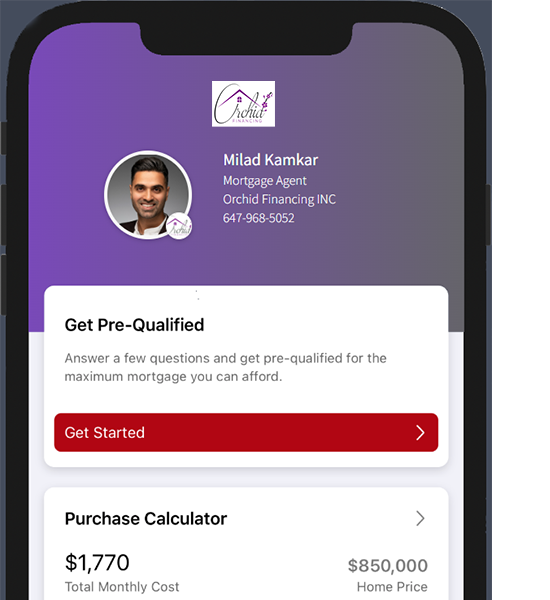

Not sure if you can afford a new home? Our team of experts offer financing solutions to help make homeownership a reality.

Own your home today!

Bad Credit Mortgage

Bad credit mortgages in Canada are a term that is used when someone who has poor credit, bad credit, horrible credit, or no credit applies for a mortgage loan.

Bad credit mortgages in Canada are mostly available through alternative lenders and through channels that are not as well known for mortgages. Since banks and many other larger institutional mortgage lenders will only approve the lending of mortgages to individuals who have good credit, great credit, or excellent credit. It is important to understand that even if your credit is not too bad, you could still get turned away by the banks when applying for a mortgage and other mortgage related loans.

If you do have bad credit and need a mortgage loan then there are ways around this issue so it is important to understand how these lenders work and what they can offer you when looking at getting approved for bad credit mortgages in Canada.

Our customers have trusted us for years, and now it’s your turn! Contact us today for more information or to apply for a mortgage.

We provide a range of mortgage products to fit your individual needs.

At Orchid Financing, we offer a range of solutions for all your home mortgage needs. Whether you’re looking to buy a new home or refinance an existing one, we’ll help you find the loan that works best for you.

A brief overview of credit

If you’ve had a rocky financial history, or if you’re new to Canada, we can help. You may be wondering how that works, so here’s the scoop:

Credit is a measure of how well you’ve paid your debts and bills in the past. Canada’s biggest credit bureaus are Equifax and TransUnion.

If your history suggests you don’t have a track record of paying back credit, you have to build it up over time, which lets you get a cheaper mortgage.

This is why it’s common to get a mortgage with a bad credit lender with a relatively high interest rate, before refinancing once you’ve proven that you pay your debts.

While you build up your credit over time and prove your ability to pay off loans responsibly, we’re here to help you get the lowest rates available.

There is also a story behind every bruised credit, and that’s something that often gets overlooked, but not with us. We understand what lenders are looking for and we also work with common sense lenders who care about the story more so than the actual score! So if you have bruised credit but have a story to tell make sure to Contact us so we can help you.

Let's improve your credit score

If you’d like to improve your credit before getting a mortgage, we’d recommend paying all your bills on time, staying within your credit limit, and only applying for credit infrequently – applying for too many credit cards can negatively affect your score.

You can watch this video to get answer to some of your questions.

FREQUENTLY ASKED QUESTIONS

FAQ

A credit score of 574 or lower is considered bad. The lowest a credit score can go is 300.

A credit score of 680 or above is considered good. The highest possible score is 900.

To build credit quickly, pay off your debts, have more than 1 credit card / line of credit. Don’t use more than 50% of your available credit. lastly, repay them on time and try to make more than minimum repayments.

There are several steps you can take, such as bringing your accounts up to date, paying off your debt and working on rebuilding your credit with a credit card or loan, to turn bad credit into good credit.

A good credit rating can save you money on interest rates and financial fees on mortgage or credit balances. It can also increase your chances of being approved if you apply for a mortgage, loan or a credit card.