SERVICES OVERVIEW

Our team is committed to finding the most economical loan for your business

Whether you are starting a new business or expanding, we have the expertise and experience to help your company succeed.

Start your loan application

Commercial & Business Loans

Our aim is to get to know every borrower and match them with the most suitable commercial mortgage for their specific needs and situation. We know how important it is to secure funding that accurately matches your expectations, business plan, and financial situation.

Our experienced and knowledgeable commercial mortgage agents can help you find the perfect loan option for your commercial property needs, whether you want to buy or invest.

Why chose our services?

- Dedicated team of underwriters for commercial and construction loans

- Many years of experience in construction, commercial and land assembly financing.

- Access to commercial private and institutional financing.

Our customers have trusted us for years, and now it’s your turn! Contact us today for more information or to apply for a mortgage.

We provide a range of mortgage products to fit your individual needs.

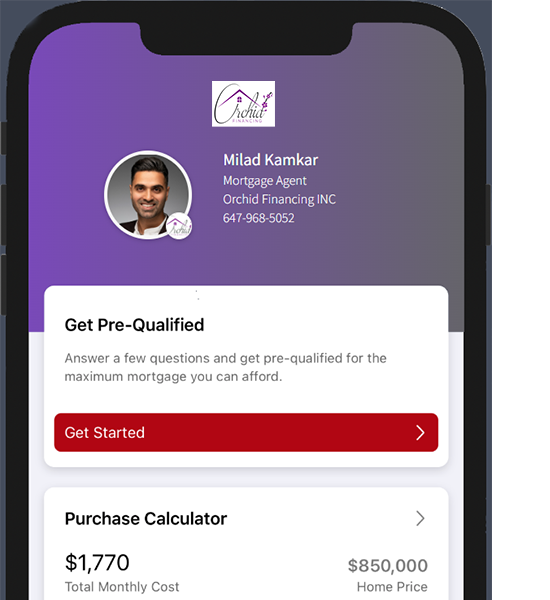

At Orchid Financing, we offer a range of solutions for all your home mortgage needs. Whether you’re looking to buy a new home or refinance an existing one, we’ll help you find the loan that works best for you.

Our commercial division specializes in the following:

- Storefront with Apartments / Residential Commercial Mixed Use

- Commercial Plaza Mortgage

- Office Mortgage

- Industrial Mortgage

- Farm Land Mortgage

- Construction Project Financing

- Land / Development Project financing

- Multi-Family Residential Apartment Buildings

FREQUENTLY ASKED QUESTIONS

FAQ

Commercial mortgages are loans for commercial properties such as stores and malls, restaurants, factories, farmland, apartments or multi-family residential buildings and even construction projects. We offer commercial mortgages for all these types of properties.

A commercial lender will consider a borrower’s debt service coverage ratio. This is the ratio of cash on hand to loan payments. The more money you have, the likelier you will be approved for the loan.

Lenders typically consider the following factors when determining whether you qualify for a commercial loan: your debt service coverage ratio, your credit history, your current business situation, the type of business you have, and the down payment you can make.

It depends on the type of property you want a loan for – it can be as low as 20% and as high as 50%.