SERVICES OVERVIEW

Consolidate Multiple Debts Into One Simple Monthly Payment

It can be a brutal task to keep track of all your various debts, find a good consolidation quote and make the move. Luckily, we can help.

Schedule a free consultation

Debt Consolidation

Debt consolidation is the process by which high-interest debt, such as credit card debt, student loans, car loans and other loans, is transformed into one single lower interest rate payment.

Consolidating debt can bring about many advantages. One of the most important is that it can, if done correctly, help you pay off your debts faster while increasing the amount of cash you keep in your pockets at the end of every month. This can reduce years of payments and save you tens of thousands of dollars in interest costs associated with the previous loans. It can also help you improve a low credit score and credit rating provided that you make your monthly payments on the new loan on time.

A debt consolidation home loan is a loan that uses the equity you have saved up in your home to help reduce all of your larger monthly payments into one single and much smaller monthly payment. This type of loan can help you save money on monthly payments by settling other higher-interest debts and replacing them with a lower-interest loan. The interest on debt consolidation loans is often substantially lower than credit card interest rates so your new monthly payment can be much cheaper than your payments were before. In fact, if you can lock in a lower interest rate and continue making the larger monthly payments towards your loan as you were prior to consolidating, you will likely be able to pay the down debt much faster than anticipated!

Our customers have trusted us for years, and now it’s your turn! Contact us today for more information or to apply for a mortgage.

We provide a range of mortgage products to fit your individual needs.

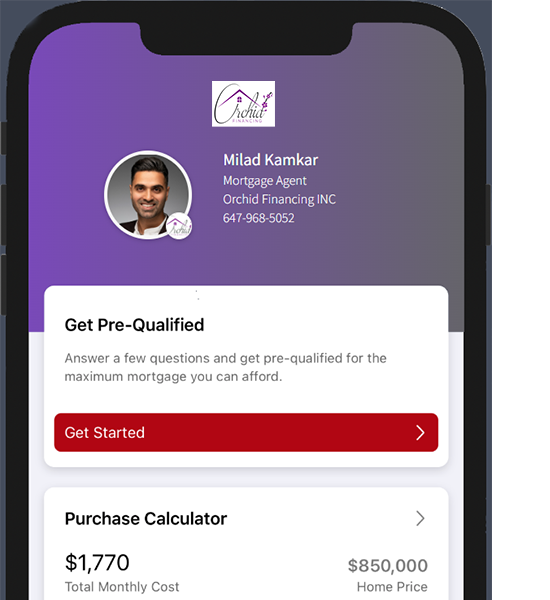

At Orchid Financing, we offer a range of solutions for all your home mortgage needs. Whether you’re looking to buy a new home or refinance an existing one, we’ll help you find the loan that works best for you.

In terms of debt consolidation, a home equity loan offers several advantages:

Consolidate Debts

Debt consolidation is a sensible financial solution for people with multiple creditors and high-interest credit card debt. The program allows you to combine your debts into a single monthly payment at a lower rate of interest, which will not only improve your financial situation, but also reduce stress and anxiety levels by eliminating the need to juggle multiple payments.

Rebuild Credit

A history of poor credit can be detrimental to people trying to improve their financial situation. Homeowners who have built up equity in their homes, however, may be able to secure a debt consolidation loan to help polish up their credit score and perhaps obtain larger loans in the future.

Reduce Stress

We have worked with hundreds of clients facing foreclosure or behind on bills and understand the extreme stress involved in these situations. Our team works hard to complete the process as quickly as possible so you can stop worrying about losing your home and get back to normal life.

Reduce Monthly Payments

Through debt consolidation, you can reduce your monthly payments by combining all of your higher-interest debts into one loan with a lower interest rate. This helps our clients not only be able to better afford their obligations, but also be able to put money aside for what matters most!

Flexible Payment Structure

No matter what your monthly household income is, if you have debt, a Debt Consolidation can be structured to ensure your monthly obligations are not too much to handle. Even clients with little or no income can have their payments tailored to match what they can afford.

Flexible Repayment Terms

Flexible repayment terms are best, because they allow you to structure the terms of your loan so that they are most advantageous to you. For example, it might be ideal to have a term that is fully open to repayment at any time without penalty.