SERVICES OVERVIEW

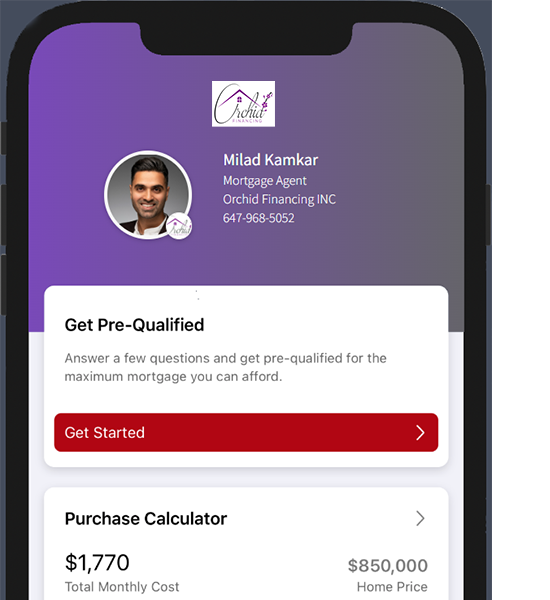

We simplify your mortgage process.

Choose from our vast product suite and take the first step towards securing your investment with a loan tailored to you.

Get started, it's free

Investment Property Mortgages

Investing in property can be a wise financial decision, but owning a rental property is different than owning your primary residence; and getting a mortgage for rental property is different from getting a conventional mortgage on your own home.

The first step in deciding which mortgage is right for you is to determine whether you are dealing with an income property, an owner-occupied property, or a second home. The main difference between a second home and any kind of investment property is that the primary purpose of a second home is to be lived in by the mortgage holder and their family. If your mortgage broker knows that you intend to use the mortgage on a second home, rather than an investment property, they will be able to offer you the correct type of mortgage for your needs.

If you plan to take out a mortgage for rental property, you must first decide whether you will live in the home with the tenants or have your own separate house. If you own a single-family home that you rent out, it is likely that you will live in a separate house and apply for a standard rental property mortgage. However, if you plan to own a duplex or triplex, and live within one of the units, you must apply for an owner-occupied mortgage—which is slightly different.

Our customers have trusted us for years, and now it’s your turn! Contact us today for more information or to apply for a mortgage.

We provide a range of mortgage products to fit your individual needs.

At Orchid Financing, we offer a range of solutions for all your home mortgage needs. Whether you’re looking to buy a new home or refinance an existing one, we’ll help you find the loan that works best for you.

When seeking Investment Property, consider the following points:

Game Plan

Before you seek financing, you will want to be clear about your goals. Are you buying only one property? Interested in investing in several different areas? Do you want to finance one property or more, and over what span of time? A good team of advisors can help with this first step.

Credit Score

To convince a lender to give you a loan, you will need to show that you have made payments on time in the past. A score of at least 680 on the credit rating scale is the minimum requirement. If your score is not quite high enough, don’t let it stop you – take action to improve it. The better your credit history, the more financing options you will have available.

Proof of Income

The lender will be looking for proof of how you will pay back the loan, and they may ask to see: a letter of employment; recent pay stubs. If you are self-employed or receive commission income, you will need to provide proof of income for the last 2-3 years in the form of NOAs and possibly T1s and/or Financial Statements for your business. If you receive income in some other way, every piece of documentation that you can provide will help put you in the best possible position for qualifying to borrow money.

Proof of Down Payment

It is common for a lender to require that you make a down payment of at least 20% of the purchase price of the investment property. The lender will then be looking for proof that your down payment isn’t borrowed. You will need banking statements to confirm that the full down payment has been in your account for at least three months before closing on the property. Alternatively, if you are planning on advancing funds from your home equity using a Home Equity Line of Credit or increasing your mortgage amount, you will need to get this set up first. You’ll then need to provide statements showing the amount advanced and deposited to your bank account and the most recent statements showing the amount now owing. Or, if the money for your down payment is coming from the sale of another property, the lender will be looking for documentation such as an agreement of purchase and sale, together with a recent mortgage statement showing how much money will be coming to you from the sale.

Emergency Funds & Closing Costs

To help ensure the successful purchase of your investment property, you will need to have at least 1.5% of the purchase price in closing costs available for the lender at closing and a contingency fund set aside that will help you deal with unexpected expenses. Many investors choose to use a HELOC (Home Equity Line of Credit) secured by their home, or money in a savings account.

Existing Property Details

As a general rule, you will need to provide the lender with mortgage statements and property tax statements for all of your properties, as well as lease agreements if they are rented. Ideally, you should be able to show that existing properties either carry themselves or that you can afford to cover any shortfall on an ongoing basis.

New Property Details

In addition to the MLS listing, Agreement of Purchase and Sale, and applicable waivers, you will need to provide either leases for the new property or a letter from an appraiser confirming the market rental prices of comparable properties.

List of Experts

To get the best results from your investment efforts, you will want to work with a good mortgage professional, real estate agent, property insurance broker, home inspector, real estate lawyer, property manager and accountant. Although you may not know people in these categories, your real estate agent or mortgage professional should be able to recommend someone. Remember to disclose all relevant information to your advisors; hiding something could cause further problems later on down the road.