SERVICES OVERVIEW

When it comes to mortgages, your options are endless.

We have a range of solutions to meet your needs when it comes to second and private mortgages.

We Have Solutions

Private & Second Mortgages

A second mortgage can be used for:

- Buy a secondary property

- Cover your home renovation expenses

- Settling any outstanding bills

- Getting cash on hand

- Financial aid to cover temporary needs.

- Plus much more!

If you’re looking to get a mortgage, but the banks and institutional lenders aren’t willing to work with you, a private lender may be the answer.

Private mortgage lenders fund real estate transactions based on the equity of the home and its location. In many cases, they offer funding when major banks or institutional lenders are unwilling to do so. They can also be useful for investors who want a fast and tailored service. Waiting for a long approval process isn’t always fun. If time isn’t on your side, or if you can’t qualify for a mortgage from a bank or institutional lender, then consider a private lender instead.A private mortgage can be used for:

- Credit management or bankruptcy recovery

- Individuals who cannot provide proof of income

- Unique properties

- Home renovation and construction

- Income taxes, property taxes, or bills that are overdue

- Plus much more!

We provide a range of mortgage products to fit your individual needs.

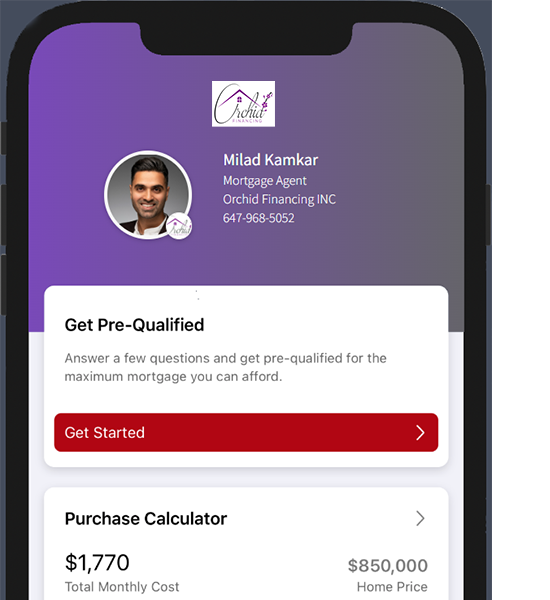

At Orchid Financing, we offer a range of solutions for all your home mortgage needs. Whether you’re looking to buy a new home or refinance an existing one, we’ll help you find the loan that works best for you.

The basics of second & private mortgages

How much can you borrow with second mortgage?

If you have built up some equity in your home, a second mortgage is a great way to access money fast.

The requirements for getting a second mortgage are simpler than ever. As a homeowner, the qualifications are based more on home equity than credit scores and income.

When applying for a second mortgage, the rates and conditions will vary according to the lender. For example, some lenders will not consider credit scores or income unless the applicant is seeking an institutional loan.

Orchid Financing has wide access to second mortgages through many our wide selection of lenders that do not require income or credit qualifications.

Second mortgage or refinance?

In some cases, it is cheaper to refinance an existing loan than take out a second mortgage due to lower interest rates.

However, there are some circumstances under which a second mortgage could be more advantageous for you. For example, your first mortgage may be locked in at a particular rate for a given period of time—a period during which you will have to pay a penalty if you close out the deal early. Secondly, your first mortgage may be locked in at a favorable rate.

Orchid Financing will guide you through your options and help you decide what’s right for you, based on your personal circumstances.

Do you need a private mortgage?

Private mortgages are popular financial solutions for homeowners who are unable to obtain bank mortgages. If you’re a homeowner in need of funds and unable to get a loan from a bank, you may be able to borrow money using a private mortgage.

How can a private mortgage work for you?

A private mortgage is a type of loan, which is typically issued by an investor or lending institution other than a bank. Private mortgages have flexible terms, which are not as stringent and drawn out as those of conventional banks. A private mortgage can be obtained by homeowners who meet certain criteria and have enough equity in their homes to secure the loan. The amount you can borrow with a private mortgage will be based on the equity in your home.

FREQUENTLY ASKED QUESTIONS

FAQ

A second mortgage will do no harm to your credit rating as long as you make your payments on time.

A second mortgage is a way of borrowing money against the value of your property. It is designed to provide consumers with quick access to funds for any number of purposes, including renovation, debt consolidation and much more.

This will vary depending on your circumstances and needs. Private mortgage lenders have more flexible lending policies than conventional banks do.

Yes, private mortgages are still simply mortgages. The only difference is that they are offered through investors who are not a bank.