SERVICES OVERVIEW

We offer an insight that others do not have.

Refinancing your mortgage has many advantages. Our services are free to use and we work with the lowest possible rates, so give us a ring today!

Refinance Your Mortgage Today!

Refinance Your Mortgage

When you refinance a mortgage, you’re effectively paying off your current loan(s) and replacing them with a special one tailored to your needs. You might decide to refinance because you want to take advantage of better interest rates that are available at that time. If the home you purchased has appreciated in value, refinancing might allow you to remove the home equity from your primary residence and place it into another asset, like an investment property. Whatever the reason, refinancing allows you to find the optimal situation for your mortgage—no matter what stage of life you’re in or what financial goals you have for yourself.

Reasons to refinance mortgage

- Take advantage of lower rates

- Get a better term

- Pay less per month

- Manage your debt

- Fund your home renovations

- Save thousands of dollars

- And much more!

We provide a range of mortgage products to fit your individual needs.

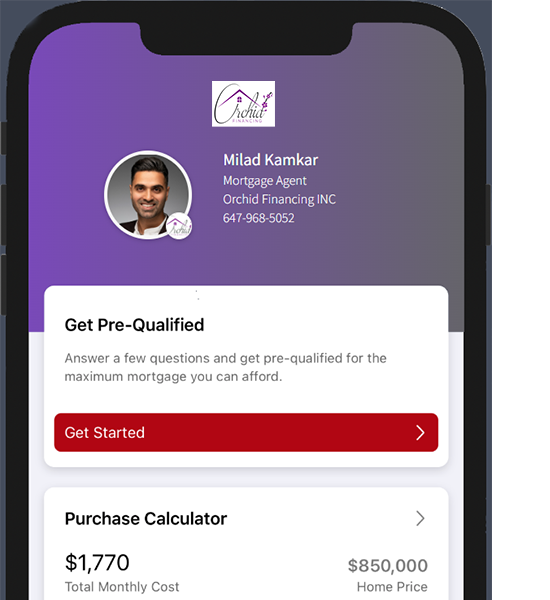

At Orchid Financing, we offer a range of solutions for all your home mortgage needs. Whether you’re looking to buy a new home or refinance an existing one, we’ll help you find the loan that works best for you.

We make sure you understand exactly what you're getting into.

Lower your interest rate and save money.

If you want to reduce your monthly mortgage payments, refinancing is a great way to do it. You can refinance a mortgage to get a lower interest rate and pay less each month. The amount and length of your original loan will affect how much you can save by refinancing.

You tend to get better rates as you pay off more of your mortgage, as it’s usually cheaper to have a loan with a 25% deposit than a 10% for example. Factors including the Bank of Canada’s Policy Interest Rate influence the state of mortgage rates at any given time, so if you know you’ll be making some major changes in your financial situation in the near future, it might make sense to wait until after those changes take place before refinancing.

Reduce your debt load, and pay off your loan more quickly.

If your priority is to pay off your loan as fast as possible, then reducing your term period can be a good option for you.

The shorter the term, the sooner you’ll be able to own your home outright.

If this sounds like a good option for you, Contact us today about refinancing your mortgage. We will evaluate all of your financial information and make sure that we find the best option for you!

Increase your cashflow by decreasing your monthly payments.

If you’re struggling to meet your monthly payments, you could always do the opposite and lengthen your mortgage term. This way you pay less per month and have a little more spending money to take care of what important to you!

When you refinance, you’ll be able to lower your monthly payment. That means more money in your pocket each month for things like vacations or whatever else you want/need!

You can borrow money against the equity in your house.

If you’re thinking about refinancing, you may be wondering if it’s a good idea. The truth is that there are many reasons to refinance your mortgage. You may want to get more up front or take a look into getting a second mortgage.

Whether you’re looking to fund your child’s education or have a home improvement project in the works, refinancing can help you get the money you need today.

FREQUENTLY ASKED QUESTIONS

FAQ

Interest rates is often considered to be the most important factor when taking out a mortgage or refinancing. However, the rate is just one component a long with perhaps 26 other components that form part of the mortgage. So whilst low interest rate is important it should not be the only factor taking into account when thinking about taking a mortgage or refinancing.

To refinance your mortgage, we will assess both your financial situation as well as the equity in your home and then compare it to the amount of money you want to borrow.

This is unique to each individual circumstances, however for any number of reasons: to reduce your interest rate, pay off your debt faster, lock in a fixed rate or switch to a variable one, or tap into your home equity and get a lump sum of cash, you might call it a good time to refinance.

We’ll walk you through the process so you know what’s involved and how much it will cost you.

You should ask your mortgage broker a number of questions to determine whether refinancing is right for you. You should ask about the interest rates, fees, and mortgage discounts available as well as how much you can expect to pay (in terms of fees and interest) over the life of your mortgage.